Our Services

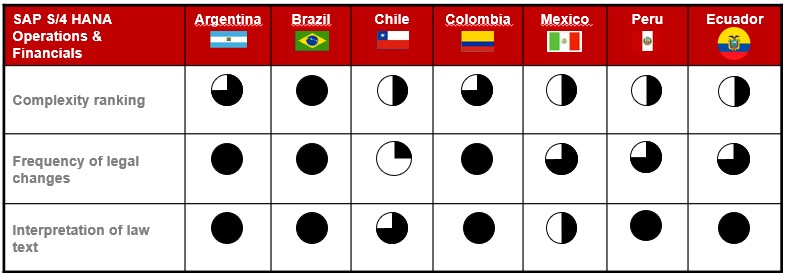

We are experienced and qualified SAP Consultants, that have implemented Localizations in the Region.

Implementation of the latest legal and taxation requirements on LATAM Countries, always emerging with the urgency of time completion.

The benefit for the customer is avoiding fines ie. lack of fiscal deductions of invoices, payments complements, credit Notes, invoice cancellations, etc.

Support to the SAP Customer through our Help Desk Ticketing System.

This support is offered for SAP SD and SAP FICO modules. We support day-to-day production issue resolutions related to e-Invoices, e-Payments, e-accounting

Projects of implementation of new functionality for e-invoice, e-payments, vendor interface, 3 PL-interface, PAC Migration, PAC communication Upgrade, and new governmental taxation requests.

CEO & Founder @ Shine Desk Solutions, CIO, IT Manager, Sr. Consultant, SAP Project Manager, SAP Delivery Manager. PMO and Help Desk Consultant